What do you mean by Alimony?

Alimony (maintenance, support or sustenance) is the financial support that is provided to a spouse after divorce. Generally, it is provided if a spouse does not have adequate means to take care of the basic needs of life. Although, according to law, alimony can be granted to either spouse, usually, it is required to be awarded by the husband to his wife. However, in exceptional cases court of law in India has gone ahead and granted alimony to husband.

There is no fixed formula or hard and fast rule for the calculation of alimony that the husband needs to provide to his wife. The alimony can be provided as a periodical or monthly payment, or as a one-time payment in the form of a lump-sum amount.

If the alimony is being paid on a monthly basis, the Supreme Court of India has set 25% of the husband’s net monthly salary as the benchmark amount that should be granted to the wife. There is no such benchmark for one-time settlement, but usually, the amount ranges between 1/5th to 1/3rd of the husband’s net worth.

2. Law related to it:

Our society consists of five major communities: Hindus (Hindus, Buddhists, Jains and Sikhs), Muslims, Christians, Parsis and Jews. Each community has its own personal laws derived from religious scriptures, customs and traditions. Thus, the grounds on which a Hindu woman can seek divorce and alimony may not be the same for every community.

Similarly, the law on alimony and maintenance also varies from personal law to personal law. For example, under the Hindu Marriage Act, 1955, both the husband and wife are legally entitled to claim permanent alimony and maintenance. However, if the couple marries under the Special Marriage Act, 1954, only the wife is entitled to claim permanent alimony and maintenance.

| Personal laws & Parameters | Hindu Law | Muslim Law | Christian Law | Parsi Law |

| Relevant legislation | i) Hindu Marriage Act, 1955 ii) Hindu Adoption And Maintenance Act, 1956 | The Muslim Women(Protection of Rights on Divorce) Act, 1986 | Indian Divorce Act, 1869 | Parsi Marriage & Divorce Act, 1988 |

| Key provisions | Hindu Marriage Act- Section 24 and Section 25 Hindu Adoption And Maintenance Act- Section 18 | Section 3(1), Section 3(2) and Section 4 | Section 36, Section 37 and Section 38 | Section39, Section 40, Section 41 & Section 42 |

| Is the husband entitled? | YES (under Hindu Marriage Act, 1955) | NO | NO | NO |

| Factors affecting the quantum of maintenance | i) Income & property of the claimant ii) Income & property against whom alimony is claimed iii) The conduct of the parties and other circumstances | i) Needs of the divorced woman ii) Standard of living at the time of marriage | i) Conduct of parties before and after marriage ii) The nature and source of husband’s income iii)Fortune of the wife & other circumstances | i) Plaintiff’s own income ii) Income of defendant |

| Payment | Lump sum or regular fixed amount | Lump sum or instalments. Even monthly payment beyond iddat period till the amount is fixed | The gross sum of money, or monthly or weekly sum paid directly to the wife herself or her trustee | The gross sum of money or monthly or periodical sum for a term not exceeding the life of the plaintiff |

3. History, philosophy and context of the concept

The Code of Hammurabi (1754 BC) declares that a man must provide sustenance to a woman who has borne him children, so that she can raise them:

137: If a man wish to separate from a woman who has borne him children, or from his wife who has borne him children: then he shall give that wife her dowry, and a part of the usufruct of field, garden, and property, so that she can rear her children. When she has brought up her children, a portion of all that is given to the children, equal as that of one son, shall be given to her. She may then marry the man of her heart.

In India, though more girls are going to school now, for many, the inevitable reality seems marriage before completion of higher education. Girls are married off early and bear children long before they should. This triggers a state of poor maternal health and is one of the root causes of high levels of child stunting and wasting in India. There is also the possibility of a marriage not working out for varied reasons, leaving the girl or young woman in extreme distress because often she is not financially independent. Parliament and the courts have persistently enacted legislation to give women better rights.

4. How it is useful or not useful:

This law has been enacted for the purpose of providing assistance to such spouse who is incapable of supporting himself or herself after separation/divorce. Alimony is very useful for the women who have been deserted by their husband. The women who are deserted by their husband are left with the mental stress and financial crunch. It becomes difficult for these women to overcome their difficulties. Even if the women found to be educated, many women left their jobs after marriage to look after their family, raise children, take care of in laws etc. So these women became dependent on their husband for finance. So after divorce the alimony amount helps these women to become emotionally and financially stable.

There is also misuse of this law. This law is enacted for the purpose of providing monetary assistance to such spouse who is incapable of supporting himself or herself. If the spouse is well qualified, s/he is not expected to remain idle to squeeze out the other. The law does not expect the increasing number of such idle persons, who, by remaining in the arena of legal battles, try to squeeze out the adversary by implementing the provisions of law suitable to their purpose.

5. Any interesting anecdote:

The Supreme Court on November 4, 2020 in the Case of Rajneesh vs Neha held that deserted wives and children are entitled to alimony/maintenance from the husbands from the date they apply for it in a court of law.

In a significant judgment by a Bench of Justices Indu Malhotra and R. Subhash Reddy, the top court said women deserted by husbands were left in dire straits, often reduced to destitution, for lack of means to sustain themselves and their children. The court opined it would not be equitable to order a husband to pay his wife permanent alimony for the rest of her life, considering the fact that in contemporary society marriages do not last for a reasonable length of time. Anyway, the court said, the duration of a marriage should be accounted for while determining the permanent alimony.

Conclusion Alimony comes as a relief to those who cannot maintain themselves owing to their personal reasons and conditions. This provision has enabled many to maintain themselves and their family. The court grants it, based on the income and assets of the husband or wife, to be given to their partner and makes a decision. It is also dependent on, under which law the petition for alimony has been filed.

What is defamation?

Defamation is the communication of a false statement that harms the reputation of an individual person, business, product, group, government, religion or nation.

Defamation refers to destroying/harming the reputation by means of slander (speech), libel (written) or both.

In India, defamation can both be a civil wrong and a criminal offence.

Law relating to Defamation:

Criminal defamation has been specifically defined as an offence under section 499 of the Indian Penal Code (IPC).

A civil wrong tends to provide for a redressal of wrongs by awarding compensation and a criminal law seeks to punish a wrongdoer and send a message to others not to commit such acts. Civil defamation is based on tort law (an area of law which does not rely on statutes to define wrongs but takes from ever-increasing body of case laws to define what would constitute a wrong).

Section 499 states defamation could be through words, spoken or intended to be read, through signs, and also through visible representations.

Section 499 also cites exceptions. These include “imputation of truth” which is required for the “public good” and thus has to be published, on the public conduct of government officials, the conduct of any person touching any public question and merits of the public performance.

Section 500 of IPC, which is on punishment for defamation, reads, “Whoever defames another shall be punished with simple imprisonment for a term which may extend to two years, or with fine, or with both.”

History, philosophy and context of the concept:

History of defamation can be traced in Roman law and German law. Abusive chants were capitally punishable in Roman. In early English and German law, insults were punished by cutting out the tongue. In the late 18th century, only imputation of crime or social disease or casting aspersions on professional competence constituted slander in England. The enactment of Slander of Women Act added imputation of unchastity illegal. French defamation laws were very severe. Conspicuous retraction of libelous matter in newspaper was severely punishable and only truth is allowed as defense when the publication related to public persons. In Italy, defamation is criminally punishable and truth seldom excuses defamation.

Misuse of the law and concerns associated:

The criminal provisions have often been used purely as a means of harassment.

Given the cumbersome nature of Indian legal procedures, the process itself turns into punishment, regardless of the merits of the case. Critics argue that defamation law impinges upon the fundamental right to freedom of speech and expression and that civil defamation is an adequate remedy against such wrongs.

Criminal defamation has a pernicious effect on society: for instance, the state uses it as a means to coerce the media and political opponents into adopting self-censorship and unwarranted self-restraint.

What has the Supreme Court said?

In Subramanian Swamy vs Union of India case 2014, the Court approved the Constitutional validity of sections 499 and 500 (criminal defamation) in the Indian Penal Code, underlining that an individual’s fundamental right to live with dignity and reputation “cannot be ruined solely because another individual can have his freedom”.

In August 2016, the court also passed strictures on Tamil Nadu Chief Minister J Jayalalithaa for misusing the criminal defamation law to “suffocate democracy” and, the court said, “public figures must face criticism”.

Shreya Singhal Vs. Union of India: It is a landmark judgment regarding internet defamation. It held unconstitutional the Section 66A of the Information Technology Act, 2000 which punishes for sending offensive messages through communication services.

Conclusion:

Reputation is an asset to each and every one. Any damage to such asset can be legally dealt with. Defamation laws have been enacted to prevent person maliciously using their right to freedom of speech and expression. An Intentional act of defamation is also punished with imprisonment which prohibits defaming a person with malice intention. The defamation law is also constitutional and is reasonable restriction on the right to free speech and expression. However, it is no defamation if the acts done fall within the exceptions provided. Over the seventy one years of Independence, there are has been numerous cases of defamation and the court has interpreted each and every case with utmost care and they serve as precedents.

Introduction:

GST return is a mechanism where a taxpayer registered under the Goods and Services Tax (GST) law has to file for each registration separately. Also, the number of GST returns to be filed will be based on the type of taxpayer, such as regular taxpayer, composition dealer, e-commerce operator, TDS deductor, non-resident taxpayer, Input Service Distributor (ISD) etc. Usually, a regular taxpayer has to file two returns per month (GSTR-1, GSTR-3B) and an annual return (GSTR-9/9C) for each GST registration separately.

Late Fee for delayed or non filing of GST Return

The GST late filing penalty has been specified as follows:

- A person fails to furnish details of outward or inward supplies, monthly return or final return by the due date – The GST penalty for late filing is INR 100 for every day during which the failure continues, subject to a maximum of INR 5,000

- A person fails to furnish the annual return by the due date – The GST late filing penalty is INR 100 for every day during which the failure continues, subject to a maximum of quarter percent of the person’s turnover in the state where he is registered

Interest for Late Payment of GST

While, the GST penalty interest rates on the applicable offences are yet to be notified, the GST late payment penalty has been specified as follows:

- A person liable to pay tax fails to pay the tax – Interest on the tax due will be calculated from the first day on which the tax was due to be paid @ 18%

- A person makes an undue or excess claim of input tax credit or undue or excess reduction in output tax liability – Interest @ 24% on the undue excess claim or undue or excess reduction

- A recipient of a service fails to pay to the supplier of the service the amount towards the value of the service, along with tax payable thereon, within 180 days from the date of issue of invoice by the supplier –Interest @ 18% on the amount due will be added to the recipient’s liability.

Which are the offences which warrant prosecution under the CGST/SGST Act?

Section 132 of the CGST/SGST Act codifies the major offences under the Act which warrant institution of criminal proceedings and prosecution. 12 such major offences have been listed as follows:

- Making a supply without issuing an invoice or upon issuance of a false/incorrect invoice;

- Issuing an invoice without making supply;

- Not paying any amount collected as tax for a period exceeding 3 months;

- Availing or utilizing credit of input tax without actual receipt of goods and/or services;

- Obtaining any fraudulent refund

- Evades tax, fraudulently avails ITC or obtains refund by an offence not covered under clause (a) to (e);

- Furnishing false information or falsification of financial records or furnishing of fake accounts/ documents with intent to evade payment of tax;

- Obstructing or preventing any official in the discharge of his duty;

- Dealing with goods liable to confiscation i.e. receipt, supply, storage or transportation of goods liable to confiscation;

- Receiving/dealing with supply of services in contravention of the Act;

- Tampers with or destroys any material evidence or documents

- Failing to supply any information required of him under the Act/Rules or supplying false information;

- Attempting to commit or abetting for any commission of any of the offences at (a) to (l) above.

What is the punishment prescribed on conviction of any offence under the CGST/SGST Act?

The scheme of punishment provided in section 132(1) is as follows:

| Offence involving | Punishment (Imprisonment extending to) |

| Tax evaded exceeding Rs. 5 crore or repeat offender 250 lakh | 5 years and fine |

| Tax evaded between Rs. 2 crore and Rs.5 crore | 3 years and fine |

| Tax evaded between Rs.1 crore and Rs.2 crore | 1 years and fine |

| False recordsObstructing officerTamper records | 6 months |

What are cognizable and non-cognizable offences under CGST/SGST Act?

In terms of Section 132(4) and 132(5) of CGST/SGST Act all offences where the evasion of tax is less than Rs.5 crores shall be non-cognizable and bailable, all offences where the evasion of tax exceeds Rs.5 crores shall be cognizable and non- bailable.

Can a company be proceeded against or prosecuted for any offence under the CGST/SGST Act?

Yes. Section 137 of the CGST/SGST ACT provides that every person who was in-charge of or responsible to a company for the conduct of its business shall, along-with the company itself, be liable to be proceeded against and punished for an offence committed by the company while such person was in-charge of the affairs of the company. If any offence committed by the company—

• has been committed with the consent/ connivance of, or

• is attributable to negligence of— any officer of the company then such officer shall be deemed to be guilty of the said offence and liable to be proceeded against and punished accordingly.

What are the powers of GST Authorities?

Goods and Services Tax (‘GST’) Authorities are empowered to arrest persons accused of offences specified under Section 132 of the CGST Act, 2017 (‘CGST Act’). The provisions of Section 132 provides that specified offences [falling under any of the clauses (a) to (d) of Section 132(1)] involving tax evasion in excess of INR 5 crores will be cognizable and non-bailable, and that officials can proceed with arrest as per the procedure laid out under Section 69 of the CGST Act. Other offences, provided under clauses (e) to (l) of Section 132(1) of the CGST Act, are bailable and non-cognizable. The specified offences are as follows:

- supply of any goods or services or both without issue of any invoice, in violation of the provisions of the Act or the rules made thereunder, with the intention to evade tax;

- issue of any invoice or bill without supply of goods or services or both in violation of the provisions of the Act, or the rules made thereunder leading to wrongful availment or utilisation of input tax credit or refund of tax;

- availment of input tax credit using such invoice or bill referred to in clause (b); collection of any amount as tax and failure to pay the same to the Government beyond a period of three months from the date on which such payment becomes due;

The GST law provides the circumstances and instances under which a person can be arrested but no guidelines have been provided in relation to the procedural aspect for arresting a person.

Amongst the offences listed above, the offences specified in (b) have gained much importance. In the past, several transactions were brought under the scanner wherein there was a supply of goods made without an actual movement of goods. This is commonly known as circular trading. The GST Authorities believe that such circular trading does not involve supply of goods even though applicable tax has been paid by each supplier in the chain. The Authorities had arrested many promoters for circular trading and escaping GST. The powers conferred upon GST Commissioners to make arrests in cases involving fake GST invoices cannot be disputed. However, the way these arrest provisions have been incorporated under the GST law is certainly amenable to a constitutional challenge.

What rights and remedies the company or alleged defaulter has?

GSTR 3A will be issued by the tax authorities to a person not filing GST return. On receiving notice in GSTR-3A Notice, the defaulter has to file the return within 15 days from the date of notice along with penalty and late fees. If the dealer still does not file return, provisions of Section 62 will apply. The proper officer will assess the tax according to his best judgment using the information available with the department. He will not issue any further notice before starting the assessment. The penalty will be Rs. 10,000 or 10% of the tax due, whichever is higher.

The defaulter shall furnish a valid return within thirty days of the service of assessment order in FORM GST ASMT-13, and thereby the said assessment order shall be deemed to have been withdrawn. But, the liability for payment of interest under section 50 or for payment of late fee under section 47 shall continue.

The cyber atrocities related to women are continuously increasing and women are very much distressed on online attacks. The Cyber attacks are threat to privacy of life as well. Hence the State of Kerala decided to amend the Police Act since the existing laws were found to be inadequate to tackle the issue. The state cabinet recommended the Governor to issue the amendment in the Act as an ordinance.

The Kerala government’s decision to amend the Kerala Police Act 2011 to curb cyber atrocities, especially against women and children has evoked strong opposition from various quarters. As per the new ordinance a new section, Section 118 – A will be added to the Police Act to give it more teeth. Under the new section, those who produce or publish defamatory or abusive content intended to defame any person through any means of communication can be imprisoned up to five years or a fine of up to Rs 10,000 or with both.

What is the ordinance?

The proposal for this ordinance (Ordinance No. 79 of 2020) actually came up over a month ago, which was finalized and received assent from Kerala Governor Arif Mohammed Khan on Saturday, 21 November.

The Kerala Police (Amendment) Ordinance, 2020 amends the Kerala Police Act, 2011 (a state-level criminal law), by adding a new Section 118A.

“118 A. Punishment for making, expressing, publishing or disseminating any matter which is threatening, abusive, humiliating or defamatory – Whoever makes, expresses, publishes or disseminates through any kind of mode of communication, any matter or subject for threatening, abusing, humiliating or defaming a person or class of persons, knowing it to be false and that causes injury to the mind, reputation or property of such person or class of persons or any other person in whom they have interest shall on conviction, be punished with imprisonment for term which may extend to three years or with fine which may extend to ten thousand rupees or with both”.

This provision will punish any kind of “communication” – including statements, articles, social media posts, etc – which threatens abuses, humiliates or defames a person or class of persons.

The person making this communication has to know that what they’re saying is false, and that it will cause “injury to the mind, reputation or property” of the targeted person or class of persons.

The punishment for this offence is up to three years’ imprisonment and/or a fine up to Rs 10,000. Even those who had just shared a post could be punished.

The ordinance was stated to come into force immediately, and like any other ordinance, had a shelf life of six months before it lapsed – though the state legislative Assembly could always pass a similar law during that period to make it permanent.

What’s the impact of it:

When the proposal for this ordinance became known, digital rights activists at the time itself raised concerns about it. The Internet Freedom Foundation, for instance, made a representation to the Kerala government asking it to scrap the idea, pointing out that it could criminalise online speech because of its “vague expressions” and that it was “liable to subjective and arbitrary application.”

However, the ordinance that was approved by the Kerala government over the weekend was actually more vague than the original proposal, expanding who could complain (persons rather than individuals, meaning companies and even deities), added vague terms like abusing and humiliating (instead of restricting to those harming the reputation of an individual, which at least was connected to defamation) and making Section 118A a cognizable offence, i.e., one that the police could investigate without a magistrate getting to scrutinize the complaint and then directing a probe (which is the case with criminal defamation, for instance).

These problematic aspects of the ordinance meant that it was actually extremely similar to the old Section 66A of the Information Technology Act that was struck down by the Supreme Court in the Shreya Singhal case in 2015 as overbroad and unconstitutional.

In fact, as was pointed out by many commentators, in that 2015 judgment, Justices Rohinton Nariman and Jasti Chelameswar also struck down a similar provision that had been added to the Kerala Police Act in 2011 (then termed Section 118(d)).

In that judgment, the apex court had held that that terms used in these provisions were too vague, and would criminalize even speech that was innocent in nature, and that therefore they could “be used in such a way as to have a chilling effect on free speech.”

Legally, therefore, this Kerala Police (Amendment) Ordinance, 2020 is on shaky grounds and is likely to be struck down as unconstitutional by the constitutional courts (i.e. the Kerala High Court or the Supreme Court).

Advantages of ordinance:

- This ordinance will sort out the problem of cyber bullying & hate speech over social & digital spaces.

- The provision will address unwarranted harassment faced by individuals, especially women and transgender community, on social media.

- This ordinance is a step to curb the false allegation made through social media and otherwise which essentially questions the liberty and constitutional dignity of persons.

- Everyone has freedom of speech and expression but if anyone makes statement threatens and defame you unnecessarily through any mode of communication then he/she will be punishable under this provision. This provision has given direct right to police to file complaint.

Disadvantages of ordinance:

- Section 118A of Kerala Police Act is similar to Section 66A of the Information Technology Act 2000 which was quashed in entirety for being unconstitutional, void and vague by Supreme Court of India. The words used in this Section 118A are used in board terms. Ordinance has the potential for great abuse against lay people and the media

- The new ordinance is anti-democratic and in violation of the Constitution. The law will lead to violation of citizens’ rights and misuse by police. With the new law in place, defamation will become a cognizable offence and a police officer can register a case and arrest the person. This law will give power to Police to arrest anyone and put in jail for even criticizing the Government.

- Despite the fact that the rate of cyber attacks is on the rise, this ordinance will do more harm than good. It will lead to a situation where no one can respond or comment on any topics. For eg:- Even a simple statement of a person stating that this Government is corrupted, will attract offense according to this new Section.

- It should not be implemented in haste. The law will adversely impact the politicians and leaders, especially during election times. But, it is a fact that even after quashing the Section 118-D of the Kerala Police Act, 2011, cases were registered under it.

Ordinance and freedom of expression

As long as the interests of people, either individually or collectively are taken care of, there can be no objection to government regulation but the problem arises when, in the name of regulation, it starts censoring i.e. encroaching upon the civil rights of the people viz. freedom of speech and expression etc. Although there are safeguards in this regard, every State tends to surpass them in some way though its magnitude may vary from State to State. Government cannot curb right to free speech even to promote general public interest.

In many ways, the new legal section in Kerala is acutely reminiscent of the notorious Section 66A of the Information Technology Act, 2000, which was struck down by the Supreme Court in the case of Shreya Singhal (2015) as ultra vires the Constitution and not to forget that in the same judgment, the Supreme Court had struck down Section 118(d) of the Kerala Police Act also as unconstitutional.

Section 118(d) read:

“Any person who causes annoyance to any person in an indecent manner by statements or verbal or comments or telephone calls or calls of any type or by chasing or sending messages or mails by any means; shall, on conviction be punishable with imprisonment for a term which may extend to three years or with fine not exceeding ten thousand rupees or with both.”

The Supreme Court held,

“What has been said about Section 66A would apply directly to Section 118(d) of the Kerala Police Act, as causing annoyance in an indecent manner suffers from the same type of vagueness and over breadth, that led to the invalidity of Section 66A, and for the reasons given for striking down Section 66A, Section 118(d) also violates Article 19(1)(a) and not being a reasonable restriction on the said right and not being saved under any of the subject matters contained in Article 19(2) is hereby declared to be unconstitutional.”

It can be easily seen that the new Section 118A tries to introduce the unconstitutional Section 118(d) of the Kerala Police Act or Section 66A of the Information Technology Act on the sly, through the backdoor, with a little window dressing.

The outlawed sections spoke of vague notions like ‘annoyance’ and ‘inconvenience’, which are not defined in law anywhere. The new Section 118(A) speaks of an equally vague concept, ‘humiliating’, which is also not defined in law anywhere.

In the Shreya Singhal judgment, the Supreme Court had quoted with approval a historic judgment of the US Supreme Court in the case of Grayned v. City of Rockford, “A vague law impermissibly delegates basic policy matters to policemen, judges, and juries for resolution on an ad hoc and subjective basis, with the attendant dangers of arbitrary and discriminatory application… Uncertain meanings inevitably lead citizens to ‘steer far wider of the unlawful zone’…than if the boundaries of the forbidden areas were clearly marked.”

The amendment to the Kerala Police Act is thus an unholy attempt to hoodwink the Supreme Court. For the reasons enunciated at length in Shreya Singhal, this Ordinance will be violation of freedom of speech.

Freedom of expression on cyber space and law to it:

The term cyber or cyberspace has today come to signify everything related to computers, the Internet, websites, data, emails, networks, software, data storage devices (such as hard disks, USB disks etc) and even electronic devices such as cell phones, ATM machines etc.

Several cybercrimes, defamation, invasion of privacy, incitement of offences, racist remarks, stalking, abuse, hacking, harassment and many more can be easily committed through social media and once such objectionable content is uploaded, it becomes viral and consequently, very difficult to contain. Hence, it is important for State to regulate the cyberspace / social media Cyber law is the law governing cyber space.

Although the Information Technology Act was in force since 2000, India did not strictly implement the Act before the 2008 terrorist attack on Mumbai. After the attacks, the Information Technology Act, 2000 was amended to expand and strengthen the monitoring and censoring capacity of the Government. The cyber law of India now contains provisions relating to blocking of websites, monitoring and collecting internet traffic data, interception or decryption of such data, unhindered access to sensitive personal data, holding intermediaries viz. social media websites liable for hosting user-generated objectionable content, etc.

CONCLUSION:

It is clearly evident that social media is a very powerful means of exercising one’s freedom of speech and expression. However, it is also been increasingly used for illegal acts which has given force to the Government’s attempts at censoring social media. Where on the one hand, the misuse of social media entails the need for legal censorship, on the other hand, there are legitimate fears of violation of civil rights of people as an inevitable consequence of censorship. What is therefore desirable is regulation of social media, not its censorship. However, the present cyber laws of India are neither appropriate nor adequate in this respect. An analysis of the existing IT laws shows that there is unaccountable and immense power in the hands of the Government while dealing with security in the cyber space. Even then, it is not sufficient to check the misuse of social media. Hence, a specific legislation is desirable to regulate social media. The government should consult experts and representatives of women organizations before bringing comprehensive legislation to curb cyber atrocities against women. The Chief Minister of Kerala said that the amendment has brought only to protect the citizens not also assured that it won’t be using it against the media person. But the provision is so vague that the police can misuse their power. Even if the victim doesn’t file complaint, under this new provision the police can suo motto file the complaint and being cognizable offence can arrest the accused event without warrant.

Introduction:

Parliamentary privileges are special rights, immunities, exceptions enjoyed by the members of the two houses of parliament and their committees. Originally the constitution envisaged two types of privileges under article 105 of the Indian constitution. One is freedom of speech in Parliament and the right of publication of its proceedings. Concept of parliamentary privilege in the Constitution of India has been taken from the British Constitution. The main motive of these privileges is to uphold the supremacy of the office of the Parliament and its members.

What is privilege motion?

The Members of Parliament are granted certain privileges individually and collectively so as to perform their duties properly. But if any of the members disregard or misuses any of these privileges or rights, it is considered as a breach of the privilege motion and is liable for punishment under the Parliamentary laws.

This motion is applicable for members of both Lok Sabha and Rajya Sabha and if any member notices another member or members breach it, they can move the privilege motion against the accused members.

What is Breach of Privilege Motion?

A breach of privilege is an infringement of any of the privileges of MPs or Parliament. Parliamentary privilege refers to the rights and immunities enjoyed by Parliament as an institution and Member of Parliament in their individual capacity, without which they cannot discharge their functions as endowed upon them by the Constitution.

What is the procedure?

- Rule No 222 in Chapter 20 of the Lok Sabha Rule Book and correspondingly Rule 187 in Chapter 16 of the Rajya Sabha rulebook govern privilege.

- It says that a member may, with the consent of the Speaker or the Chairperson, raise a question involving a breach of privilege either of a member or of the House or of a committee thereof.

- The rules however mandate that any notice should be relating to an incident of recent occurrence and should need the intervention of the House. Notices have to be given before 10 am to the Speaker or the Chairperson.

- The Speaker/RS chairperson is the first level of scrutiny of a privilege motion. The Speaker/Chair can decide on the privilege motion him or herself or refer it to the privileges committee of Parliament.

- If the Speaker/Chair gives consent under Rule 222, the member concerned is given an opportunity to make a short statement. In the Lok Sabha, the Speaker nominates a committee of privileges consisting of 15 members as per respective party strengths.

- In the Rajya Sabha, the deputy chairperson heads the committee of privileges that consists of 10 members. A report is then presented to the House for its consideration.

- The Speaker may permit a half-hour debate while considering the report. The Speaker may then pass final orders or direct that the report be tabled before the House. A resolution may then be moved relating to the breach of privilege that has to be unanimously passed.

What impact it can have?

The Privileges are given to the members of Parliament so that they discharge their duty properly without any destruction. There have been various complains raised for the breach of the privilege motion. There have a few cases that had gather a lot of public attention. Few of the most important ones are mentioned below:

In most recent time, Shiv Sena MLA Pratap Sarnaik had moved the breach of privilege motion, accusing Arnab Goswami of using derogatory language against Maharashtra Chief Minister Uddhav Thackeray and Nationalist Congress Party Sharad Pawar. A similar privilege motion has been moved against actor Kangana Ranaut for claiming that Mumbai resembles Pakistan-occupied Kashmir.

In December, 2018, breach of privilege motion was passed on to then Prime Minister and the Defense Minister of the country, claiming that they had misled the members of the Parliament and the Supreme Court on the Rafale fighter jet deal.

The most significant privilege motion was passed in 1978 against Indira Gandhi. The motion was passed on by the then Home Minister Charan Singh claiming excesses made by her during Emergency. She was found guilty and was expelled from the House. In another case, in 1976, Subramanian Swamy, MP was expelled from the Rajya Sabha for disgracing the Indian Parliament through his interviews to foreign journals.

Multiple other cases have been recorded and many have been rejected by the Committees of both the Houses of Parliament. The major reason to introduce the privilege motion was to ensure that no Minister misuses his powers once he gets the privileges of a person of higher authority.

Is Privilege motion same like contempt?

Contempt of the House may be defined generally as “any act or omission which obstructs or impedes either House of Parliament in the performance of its functions, or which obstructs or impedes any Member or officer of such House in the discharge of his duty, or which has a tendency directly or indirectly, to produce such results.”

It may be stated that it is not possible to enumerate exhaustively every act which might be construed by the House as contempt of the House. Some of the important types of contempt of Parliament are, however, mentioned below:-

- Speeches or writings reflecting on the House, its Committees or Members;

- Reflections on the character and impartiality of the Chairman/Speaker in the discharge of his duty;

- Publication of false or distorted report of the Proceedings of the House;

- Publication oil expunged proceedings of the House;

- Publication of proceedings of secret Sessions of the House;

- Pre-mature publication of proceedings, evidence or report of a Parliamentary Committee;

- Reflections on the report of a Parliamentary Committee;

- Molestation of Members on account of their conduct in the House or obstructing Members while in the performance of their duties as Members or while on their way to or coming after, attending the House or a Committee thereof;

- Offering bribes to Members to influence them in their Parliamentary conduct; Intimidation of Members in connection with their Parliamentary conduct;

- Any misconduct or undignified behaviour on the part of a Member, such as, corruption in the execution of his office as Member, disorderly and undignified conduct contrary to the usage or inconsistent with accepted standards of Parliamentary conduct;

- Obstructing or molesting officers of the House in the discharge of their duties; Giving false or misleading evidence or information deliberately to the House or a Committee thereof, by a Member or a witness.

What is the punishment for an individual who is found guilty of breaching the legislature’s privilege?

If the Committee finds the offender guilty of breach of privilege and contempt, it can recommend the punishment. The punishment can include communicating the displeasure of the state legislature to the offender, summoning the offender before the House and giving a warning, and even sending the offender to jail.

In the case of the media, press facilities of the state legislature may be withdrawn, and a public apology may be sought.

Conclusion:

Both the Parliament and State Legislatures have a duty to look carefully before making any law, so that it doesn’t harm other rights. It is also a duty of the members to properly use these privileges and not misuse them for alternate purposes that is not in the favour of general interest of nation and public at large. Thus what we must keep in mind is the fact that power corrupts and absolute power corrupts absolutely. For this not to happen under the privileges granted, the public and the other governing body should always be on vigil.

Introduction:-

Talaq in its primitive sense means dismission. In its literal meaning, it means “setting free”, “letting loose”, or taking off any “ties or restraint”. In Muslim Law it means freedom from the bondage of marriage and not from any other bondage. In legal sense it means dissolution of marriage by husband using appropriate words. In other words talaq is repudiation of marriage by the husband in accordance with the procedure laid down by the law.

The Muslim Women (Protection of Rights on Marriage) Bill, 2019 was introduced in Lok Sabha by the Minister of Law and Justice, Mr. Ravi Shankar Prasad on June 21, 2019. It replaces an Ordinance promulgated on February 21, 2019.

The Bill makes all declaration of talaq, including in written or electronic form, to be void (i.e. not enforceable in law) and illegal. It defines talaq as talaq-e-biddat or any other similar form of talaq pronounced by a Muslim man resulting in instant and irrevocable divorce.

Talaq-e-biddat refers to the practice under Muslim personal laws where pronouncement of the word ‘talaq’ thrice in one sitting by a Muslim man to his wife results in an instant and irrevocable divorce.

Why this law came into practice?

A Muslim marriage is a pure civil contract and as per sharia law, a Muslim marriage can take place only when both parties agree, so how can one person unilaterally divorce another? Instant triple talaq violates women’s fundamental rights at a large. Marriage is a two way agreement between a man and a women which is equally binding on both and provides a mutual separation. The Triple Talaq makes it a one sided affair and gives all the prerogative to the husband to walk out of this alliance at his whims.

Triple talaq is not integral to religious practice and violates constitutional morality. It is manifestly, arbitrary to allow a man to break down a marriage whimsically and capriciously. What is sinful under religion cannot be valid under law.

In India, a Muslim man can instantly divorce his wife by uttering the word “TALAQ” three times. The Muslim women were subjected to cruelty by Muslim male and it was getting misused by men for the wrongful acts. For example: – If a women is not able to give a birth to a male child, or a small quarrel between husband and wife, or in a rage or anger. Thus, Muslim men’s misusing Triple Talaq without any reason as a matter of their rights.

Because of this cruelty and injustice, women have to suffer and have to live a miserable life and thus, they were not even secured from their own husband. Therefore, this new law came into force on 19th day of September, 2018 for the empowerment and safety to the women.

Salient features:-

- The act deals with Talaq-e Biddat, a form of instant and irrevocable divorce given by Muslim men. It is recognized under Muslim Personal Law, where saying the word ‘Talaq’ thrice in one sitting by a man to his wife leads to instant divorce.

- The act considers all declaration of triple talaq electronically or in written form as void.

- The act declares triple talaq as a ‘cognizable offence’ (i.e., a police officer can arrest the accused without a warrant) and will attract three years of imprisonment with fine. The act also describes that, the offence will be cognizable only if information relating to the offence will be given by, the married woman (against whom talaq has been declared) or any person related to her by blood or marriage.

- The magistrate can grant bail to the accused after hearing the plea of the woman (against whom talaq has been declared) and finding reasonable grounds for granting bail.

- The act also gives the provision of the settlement of the dispute between both the parties i.e., the one giving the divorce and the woman against whom the divorce is declared. But the terms and conditions of the offence will be determined by the Magistrate.

- The Muslim woman, who is the victim of triple talaq, will be liable to get an allowance from her husband for herself and her dependent children. The Magistrate will also determine the allowance that she will receive.

- The Magistrate will also determine the manner of custody of the minor children that will be granted to the woman in case she seeks it.

How this law will help Muslim women?

Instant divorce is banned in 22 countries, including Pakistan and Bangladesh.

This law protects the women as the husband cannot give the “Instead Talaq”, if he does then, he will be punishable by the law and thus, the husband have to think thrice before pronouncing the word “Talaq” thrice.

The practice of this law will help the women from getting their fundamental rights and this instead talaq will stopped in the Muslim community.

It gives Muslim women equal rights to take decisions about the divorce.

The court said the practice is unconstitutional arbitrary and not a part of Islam.

This law criminalization triple talaq and it awards three years imprisonment to husband and also compensation to his wife along with the custody of children.

The triple talaq law makes declaration of Talaq-e-biddat in spoken, written or through SMS or WhatsApp or any other electronic chat illegal. Talaq-e-biddat refers to the pronouncement of talaq three times by a Muslim man in one sitting to his wife resulting in an instant and irrevocable divorce.

In India, the Muslims are governed by

- The Muslim Personal Law (Shariat) Application Act, 1937: This law deals with marriage, succession, inheritance and charities among Muslims

- The Dissolution of Muslim Marriages Act, 1939: This law deals with the circumstances in which Muslim women can obtain divorce.

- The Muslim Women (Protection of Rights on Divorce) Act, 1986: This law deals with the rights of Muslim women who have been divorced by their husbands and to provide for matters connected therewith.

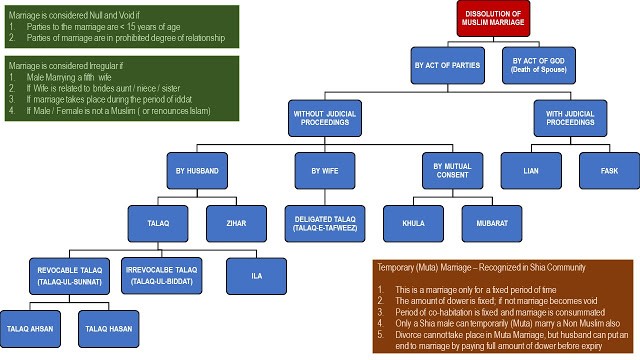

Modes of Divorce

- A husband may divorce his wife by repudiating the marriage without giving any reason. Pronouncement of such words which signify his intention to disown the wife is sufficient. Generally this done by talaq. But he may also divorce by Ila, and Zihar which differ from talaq only in form, not in substance.

- A wife cannot divorce her husband of her own accord. She can divorce the husband only when the husband has delegated such a right to her or under an agreement. Under an agreement the wife may divorce her husband either by Khula or Mubarat.

- Before 1939, a Muslim wife had no right to seek divorce except on the ground of false charges of adultery, insanity or impotency of the husband. But the Dissolution of Muslim Marriages Actext-justifyt 1939 lays down several other grounds on the basis of which a Muslim wife may get her divorce decree passed by the order of the court.

The way out for a Muslim women if they want to take divorce:-

Chapter XVI of Principles of Mahomedan Law deals with DIVORCE.

Section 307 – Different forms of divorce:

The contract of marriage under the Mahomedan law may be dissolved in any one of the following ways:

- By the husband at his will, without the intervention of the Court;

- by mutual consent of the husband and wife, without the intervention of a Court;

- By a judicial decree at the suit of the husband or wife.

When the divorce proceeds from the husband, it is called “TALAQ”.

As per section 308 of principles of Mahomedan law; any Mahomedan of sound mind, who has attained puberty, may divorce his wife whenever he desires without assigning any cause.

Section 311 of Principles of Mahomedan Law deals with different modes of talaq – A talaq may be effected in any of the following ways –

- Talaq Ahsan – This consists of a single pronouncement of divorce made during a tuhr (period between menstruations) followed by abstinence from sexual intercourse for the period of iddat.

- Talaq Hasan – This consist of three pronouncement made during successive tuhrs, no intercourse taking place during any of the three tuhrs.

- Talaq al biddat – This consists of three pronouncements made during a single tuhr either in one sentence or a single pronouncement made during a tuhr clearly indicating an intention irrevocably to dissolve the marriage.

The latter includes: the proclamation of divorce by the husband; divorce initiated by his wife; divorce by mutual consent. An out-of-court divorce may qualify as Talaq al-Sunna, i.e. performed in accordance with the [established by the Prophet] rules, “approved”, or as Talaq al-Biddat, – “new” or “not approved”.

“Approved” divorce implies that the husband waits for three months after the first (single) pronouncement of the word talaq; however, reconciliation is possible between the spouses. In the case of “unapproved” divorce, the marriage is considered to be finally terminated immediately after the spouse’s “triple talaq” formula was pronounced, and there is no chance of resolving the situation.

When it is said the third time at the end of iddat it becomes final, though even without the third time, talaq becomes final when iddat expires. The only difference between two pronouncements and three pronouncements is that the couple is free to remarry in case of the latter but not in case of the former. The triple instantaneous talaq is – or was – essentially talaq of the three times but said at one sitting instead of over three months. So, essentially the only difference was that the husband denied himself the right to take it back or indeed to remarry the ex-wife after iddat. For the woman there was no real difference so long as the husband’s obligation of the iddat period was observed, as they must.

In recent years, with the development of new technologies, the tradition under consideration in India has undergone certain metamorphoses. The development of technologies does not level out traditional practices, but, on the contrary, contributes to their further development or even misuse – as is the case with the Muslim “divorce formula” – a kind of perverted modernization. According to the norms of Sharia, husbands are obliged to pronounce the word “talaq” in front of witnesses or at least in the presence of a wife. At the same time, there are frequent cases when men sent spouses either a text message with the word “talaq, talaq, talaq”, or a similar message in messengers like WhatsApp, Skype, etc. Thus, over the decade (2007–2017), the Muslim Movement of India has recorded many instances of such a “high-tech” divorce, as a result of which women with children in an instant found them outside the doorstep.

If the Marriage is registered as per the provisions of Muslim law, the divorce too will be governed under the procedures of and as per the provisions of Muslim Law.

Note: – If a Muslim male and female get married and the Marriage is registered under the special marriage act than the procedure followed for divorce need not follow the Muslim Personal law.

Section 2 in the Dissolution of Muslim Marriages Act, 1939 deals with the grounds for decree for dissolution of marriage.

A woman married under Muslim law shall be entitled to obtain a decree for the dissolution of her marriage on any one or more of the following grounds, namely:

- That the whereabouts of the husband have not been known for a period of four years;

- That the husband has neglected or has failed to provide for her maintenance for a period of two years;

- That the husband has been sentenced to imprisonment for a period of seven years or upwards;

- That the husband has failed to perform, without reasonable cause, his marital obligations for a period of three years;

- That the husband was impotent at the time of the marriage and continues to be so;

- That the husband has been insane for a period of two years or is suffering from leprosy a virulent venereal disease;

- That she, having been given in marriage by her father or other guardian before she attained the age of fifteen years, repudiated the marriage before attaining the age of eighteen years:

Provided that the marriage has not been consummated; - That the husband treats her with cruelty, that is to say,

- habitually assaults her or makes her life miserable by cruelty of conduct even if such conduct does not amount to physical ill-treatment, or

- Associates with women of evil repute or leads an infamous life, or

- Attempts to force her to lead an immoral life, or

- Disposes of her property or prevents her exercising her legal rights over it, or

- Obstructs her in the observance of her religious profession or practice, or

- If he has more wives than one, does not treat her equitably in accordance with the injunctions of the Quran;

- On any other ground which is recognized as valid for the dissolution of marriages under Muslim law;

Provided that-- No decree shall be passed on ground (iii) until the sentence has become final;

- a decree passed on ground (i) shall not take effect for a period of six months from the date of such decree, and if the husband appears either in person or through an authorized agent within that period and satisfies the Court that he is prepared to perform his conjugal duties, the Court shall set aside the said decree; and

- before passing a decree on ground (v) the Court shall, on application by the husband, make an order requiring the husband to satisfy the Court within a period of one year from the date of such order that he has ceased to be impotent, and if the husband so satisfies the Court within such period, no decree shall be passed on the said ground.

Thus, a Muslim marriage may be dissolved by pronouncing talaq. It may also be dissolved by an agreement between the husband and wife. When it is the letter it is known as khula. Ghansi Bibi v. Ghulam Dastagir (1968) 1 Mys. LJ. 566.

Offence and penalty:-

Section 3 of protection of rights on marriage act, 2019:-

Any pronouncement of talaq by a Muslim husband upon his wife, by words, either spoken or written or in electronic form or in any other manner whatsoever, shall be void and illegal.

Section 4 of protection of rights on marriage act, 2019:-

Any Muslim husband who pronounces talaq referred to in section 3 upon his wife shall be punished with imprisonment for a term which may extend to three years, and shall also be liable to fine.

The act makes declaration of talaq a cognizable offence, attracting up to three years’ imprisonment with a fine. (A cognizable offence is one for which a police officer may arrest an accused person without warrant.) The offence will be cognizable only if information relating to the offence is given by:

- The married woman (against whom talaq has been declared), or

- Any person related to her by blood or marriage.

The act provides that the Magistrate may grant bail to the accused. The bail may be granted only after hearing the woman (against whom talaq has been pronounced), and if the Magistrate is satisfied that there are reasonable grounds for granting bail. – As per Section 7 (c) of the protection of rights on marriage, 2019.

The offence may be compounded by the Magistrate upon the request of the woman (against whom talaq has been declared). Compounding refers to the procedure where the two sides agree to stop legal proceedings, and settle the dispute. The terms and conditions of the compounding of the offence will be determined by the Magistrate.

Allowance:–

As per section 5 of PROTECTION OF RIGHTS OF MARRIED MUSLIM WOMEN:-

Without prejudice to the generality of the provisions contained in any other law for the time being in force, a married Muslim woman upon whom talaq is pronounced shall be entitled to receive from her husband such amount of subsistence allowance, for her and dependent children, as may be determined by the Magistrate.

Thus, a Muslim woman against whom talaq has been declared, is entitled to seek subsistence allowance from her husband for herself and for her dependent children. The amount of the allowance will be determined by the Magistrate.

Custody:-

As per section 6 of PROTECTION OF RIGHTS OF MARRIED MUSLIM WOMEN:-

Notwithstanding anything contained in any other law for the time being in force, a married Muslim woman shall be entitled to custody of her minor children in the event of pronouncement of talaq by her husband, in such manner as may be determined by the Magistrate.

Thus, a Muslim woman against whom such talaq has been declared, is entitled to seek custody of her minor children. The manner of custody will be determined by the Magistrate.

Conclusion:-

According to Muslim Personal Law, triple talaq is invalid and unlawful from the very onset. In Bangladesh and Pakistan, Triple Talaq is null and void. No talaq can be given at the state of anger. Basically, it’s an instrument for oppression of helpless women. Triple Talaq hardly happens in well to do families. We welcome Triple Talaq bill (Now an Act) as it empowers women and male autocracy is curtained. The Muslim women finally asserting themselves to seek their space in a male-dominated society.